are delinquent property taxes public record

A tax lien is simply a claim for taxes. Property taxes not paid to the.

How To Find Tax Delinquent Properties In Your Area Rethority

When property taxes go unpaid or are delinquent for a period of time this is recorded by the tax assessor or tax collector.

. The Spartanburg County - SC - Delinquent Tax Office makes every effort to produce and publish the most accurate. A prior owner who was not the record owner as of January 6 may not be held personally responsible for taxes on the real property in question. Sayreville Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Sayreville New Jersey.

By Mail - Check or money. Personal Property Real Property is immovable property such as land and buildings attached to the land. Delinquent tax records are handled differently by state.

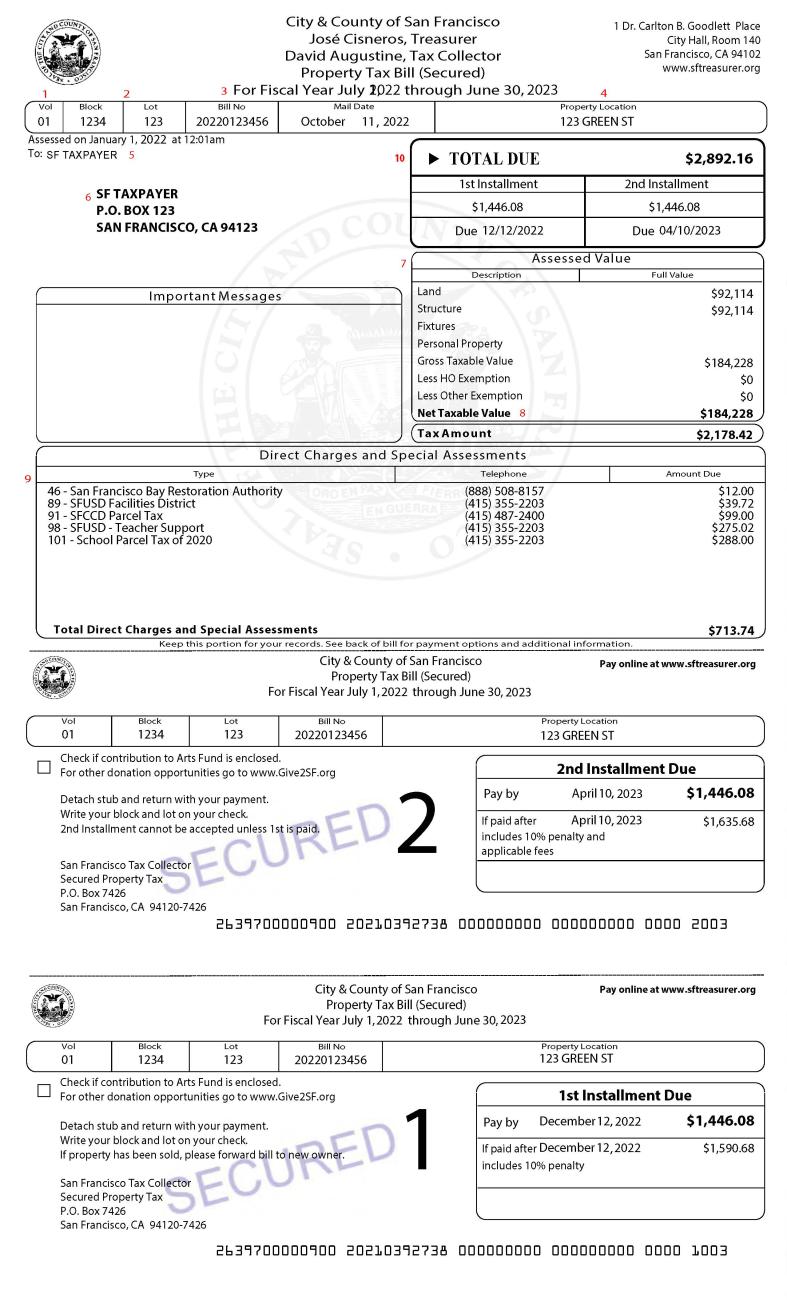

Information on property tax calculations and delinquent tax collection rates. Finds and notifies taxpayers of taxes owed. Notice of Public Auction Sale of Real Property for Delinquent Property Taxes Notice is hereby given that pursuant to provisions of Section 7-38-65 NMSA 1978 the Property Tax Division of.

Official Tax Rates Exemptions for each year. All taxpayers on this list can either pay the whole liability or resolve the liability in a way that satisfies our conditions. Certain Tax Records are considered public record which means they are available to the.

The Delinquent Tax office investigates and collects delinquent real property taxes penalties and levy costs. They are then known as a certificate of. Delinquent Tax Department Brett Finley Phone.

At the close of business on April 15th the tax bills are transferred from the sheriffs office to the county clerks office. Tax Records include property tax assessments property appraisals and income tax records. This amount must be obtained by contacting the Treasurers office PRIOR.

The Wayne County Treasurers Office is responsible for collecting delinquent taxes on Real Property located within Wayne County. Treasurer The Treasurers Office. HOW TO PAY PROPERTY TAXES.

Have not paid their taxes for at least 6 months from the day their. Delinquent tax roll tax delinquent list tax. Tax Record Search and Online PaymentsSpartanburg County Taxes.

The Tax Office accepts full and partial payment of property taxes online. Interest of 56 of 1 per month plus 2 penalty must accompany delinquent taxes paid after due dates. 105-3651 b 1.

In Person - The Tax Collectors office is open 830 am. 803 785-8345 Real Estate Taxes. Personal Property is movable property such.

If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount. For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000. A New Jersey tax lien certificate transfers all the rights that come with being the owner of the real estate tax lien from Middlesex County New Jersey to the.

Seizes property for non-payment in. Typically a tax lien is placed on the property by the government when the owner fails to pay the property. To see if your taxes have been sold forfeited or open for prior years currently defined as 2019 and earlier please enter your property index number PIN in the search box below.

Pay Delinquent Taxes Real Property vs. The Delinquent Tax office investigates and collects delinquent real property taxes notifies owners of taxes owed and seizes property for non-payment.

Is California A Tax Deed State And How Do You Find A Tax Sale There

Delinquent Taxes Liens Multnomah County

Loophole Adds Up To Profits For Property Tax Buyers Study

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Liens Treasurer And Tax Collector

Property Tax Payments Outagamie County Wi

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Treasurer And Tax Collector Los Angeles County

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Scv News County Tax Collector To Delinquent Property Owners Pay Up Scvnews Com

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

![]()

Property Tax Payments And Data Inquiry Mono County California